INTRODUCTION

Financial constraints can frequently impede the pursuit of justice by individuals and businesses in the intricate realm of litigation. This is where litigation financing becomes a game-changing factor. Litigation financing provides a reprieve to individuals who may otherwise be unable to afford the lengthy and costly legal process by providing essential funds to cover the costs of legal action. Nevertheless, it introduces a multitude of factors that potential litigants must carefully evaluate, in addition to opening doors to justice. We will investigate the multifaceted nature of litigation financing in this article, examining its potential drawbacks and benefits. Additionally, it will discuss specific firms that have participated in litigation finance in India and the USA. You can make an informed decision regarding the compatibility of this financial instrument with your legal and financial objectives by comprehending both the benefits and the obstacles.

PROS OF LITIGATION FINANCING

- Access to Justice

The democratization of access to justice is one of the most significant benefits of litigation financing. Legal action may be pursued by individuals or enterprises with meritorious claims but limited financial resources, which they would otherwise be unable to pursue. Litigation financing ensures that justice is not exclusively reserved for those who can afford it by alleviating the financial burden.

- Risk Mitigation

Litigation is unpredictable, and there is no assurance of a favorable outcome. By enabling the financed party to prosecute their claim without risking their own capital, litigation financing mitigates a portion of this risk. The plaintiff is safeguarded from accruing additional debt or losing personal assets if the case is unsuccessful, as the financier typically absorbs the loss.

- Repayment is contingent upon success

Litigation financing is frequently structured as a non-recourse loan. This implies that the plaintiff is not required to reimburse the financier in the event that the case does not yield a favorable outcome. This structure reduces the financial risk for the plaintiff, enabling them to pursue legal claims without the concern of significant financial loss.

- Enhanced Case Outcomes

Litigants can afford to retain the services of top-tier legal counsel, accumulate substantial evidence, and conduct exhaustive investigations when they have access to additional funding. This has the potential to improve the quality of legal representation and increase the likelihood of a successful outcome. Furthermore, the supplementary funds can facilitate the legal procedure, thereby minimizing the duration of litigation.

- Enhances Efficiency

Litigation financing firms are incentivised to invest in cases that they believe have a high likelihood of success. Consequently, they frequently advocate for the expedient resolution and management of cases. This can result in more expedited settlements and fewer protracted legal disputes, which are advantageous to all parties.

CONS OF LITIGATION FINANCING

- Expensive Fees and Costs

Although litigation financing is indispensable, it incurs expenses. Interest rates and fees associated with litigation funding may be extremely costly. Financiers typically retain a portion of the settlement or judgment, which can substantially diminish the plaintiff’s final compensation. The benefits may be outweighed by the cost of financing for certain individuals, particularly if the case is settled for a lower amount than originally anticipated.

- Potential for Conflicts of Interest

Conflicts of interest may be introduced into the litigation process by the involvement of a third-party financier. Financiers may have their own objectives and may apply pressure to the plaintiff to resolve the case expeditiously, even if it is not in their best interest. This dynamic has the potential to compromise the plaintiff’s objectives by influencing legal strategies and decision-making.

- Limited Control Over Legal Strategy

The plaintiff may have less influence over the legal strategy and decisions when a third-party financier is involved. In order to optimize their return on investment, financiers may attempt to influence the case’s trajectory. As a result, the plaintiff’s interests may not be entirely congruent with the financier’s objectives.

- Influence on Settlement Negotiations

Settlement negotiations may be influenced by litigation financing. The plaintiff’s dependence on external funding may be recognised by the defendants, who may exploit this information during negotiations. This could lead to more aggressive defense tactics or lower settlement offers, as the plaintiff may be under pressure to compromise.

- Potential stigma

Litigation financing may be stigmatized by certain individuals, who may interpret it as an indication of financial vulnerability or desperation. This perception has the potential to influence the plaintiff’s reputation or relationship with legal counsel, which could potentially affect their position in negotiations or court.

FIRMS ENGAGED IN LITIGATION FINANCING

INDIA:

- Treelife

Treelife is a legal consultancy that specializes in providing litigation funding services to startups and young companies. They provide financial support for litigation to help businesses overcome legal obstacles and ensure that enterprises may obtain the necessary legal representation without being hindered by financial limitations.

- LegalPay

LegalPay is a famous litigation financing firm in India that specializes in offering financial assistance to businesses and individuals engaged in legal disputes. Their main area of expertise lies in business litigation, and they provide customized funding solutions to clients, enabling them to seek justice without the financial strain of paying legal bills upfront.

- Singularity Legal

Singularity Legal is an exclusive international disputes firm located in India that offers specialized lawsuit finance options. The company collaborates with financial institutions to assist clients in significant commercial disputes, with a particular emphasis on international arbitration and litigation that spans across borders.

- S. A. :

- Burford Capital

Burford Capital is a prominent litigation finance company in the United States that offers financial support for various legal issues, such as commercial litigation, arbitration, and other legal conflicts. They provide an extensive array of financial options to assist clients in effectively handling litigation expenses and enhancing results in significant legal conflicts.

- LexShares

LexShares is a litigation finance organization headquartered in the United States. It facilitates the connection between investors and plaintiffs involved in high-stakes commercial actions. They provide financing options for plaintiffs and law firms, allowing them to undertake legal proceedings without incurring initial financial obligations. LexShares specializes in business litigation, namely handling matters related to securities fraud, intellectual property disputes, and class actions.

- Omni Bridgeway

Omni Bridgeway, formerly known as Bentham IMF, is a prominent international litigation finance company that has a significant presence in the United States. They offer financial support for intricate business lawsuits and arbitration, enabling corporations and individuals to pursue valid claims without the usual financial hazards that come with prolonged legal disputes.

CONCLUSION

Litigation financing is a critical factor in contemporary legal practice, providing plaintiffs with a substantial opportunity to pursue their cases despite financial constraints. Its transformative potential is emphasized by its capacity to democratize access to justice, mitigate financial risk, and improve case outcomes. Nevertheless, this financial instrument is not without its complexities and expenses. It is imperative to meticulously evaluate the potential for high fees, conflicts of interest, and diminished control over legal strategies.

Increasing regulation and innovative funding models are intended to address these challenges and offer more balanced solutions as the litigation financing landscape evolves. A comprehensive comprehension of the terms and implications is imperative for those who are navigating this option. Plaintiffs can make decisions that are consistent with their pursuit of justice by evaluating the advantages and disadvantages and obtaining the guidance of a professional. Ultimately, litigation financing can be a valuable ally in the pursuit of a fair resolution, provided that it is conducted with strategic insight and cautious consideration.

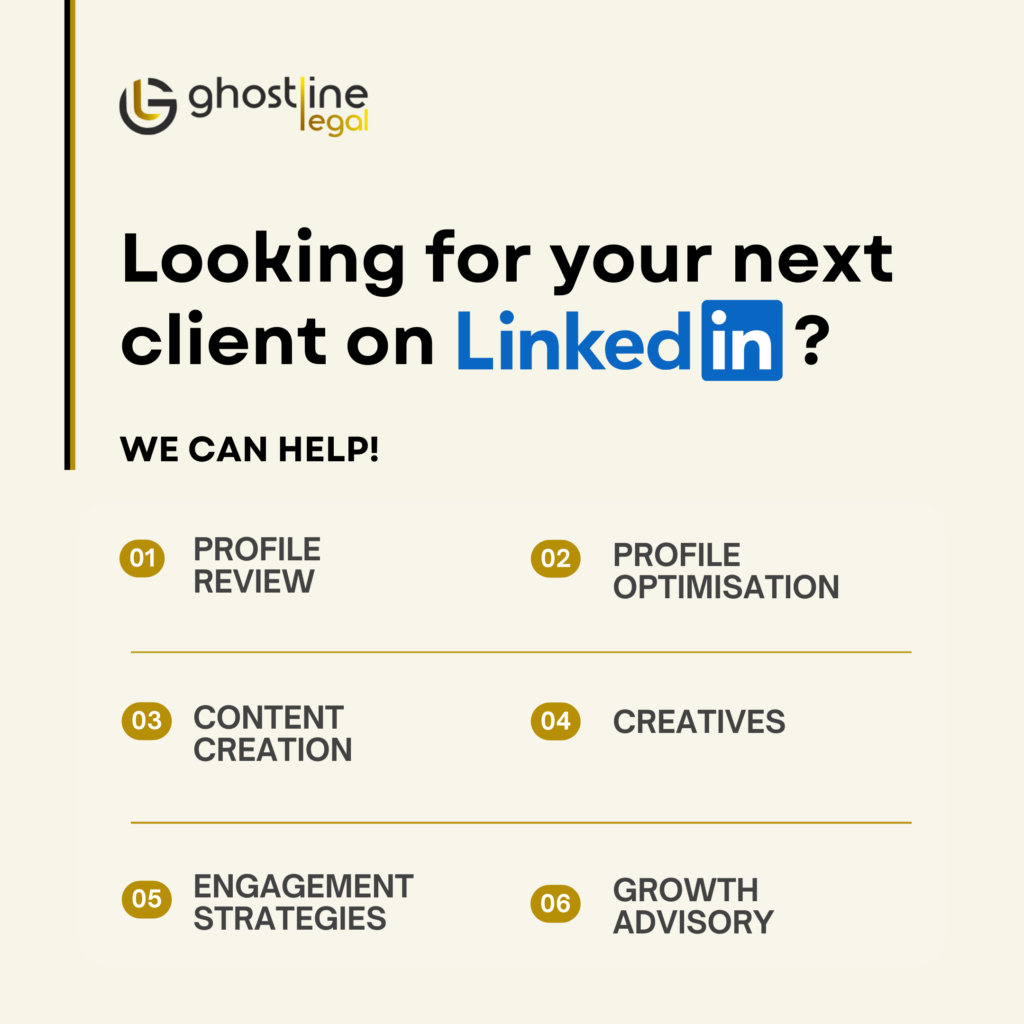

Ghostline Legal is India’s first full-service BCI-compliant tech firm for litigation chambers and law firms. Check our services HERE.